A Middle class is a rare thing, occurring only 3 times thru-out history. The first rising of a middle class occurred as a result of the Black Plague. The Black Plague killed about 30% of the worlds population, creating a labor shortage. This allowed that Trades & Craftsman to command a higher wage, which trickled down to the common yeoman, much as the unionization of US labor in the middle 1900's allowed non union labor to command wages akin to union labor. Some have written that the renaissance, without a middle class that had the leisure time to even consider art & music, let alone the time to paint, sculpt, write & perform music, would have never occurred.

The second rising of a middle class occurred in the US colonies in the middle 1700's. Once a few Indians were driven away from an area, there was free land available for farming. In an agrarian society this was a big deal in that you could own your own land, grow & sell your own crops & keep the profits, much as a family owned business does today.

The third rising of a middle class occurred during the Great Republican Depression of the early 1930's. FDR's New Deal brought forward tax progressivity, as well as labor rights earned thru the union movement, such as the Child Labor laws passed in 1937 & 1938, (Kids do belong in school after all). But I've gotten ahead of myself, let me backtrack a bit.

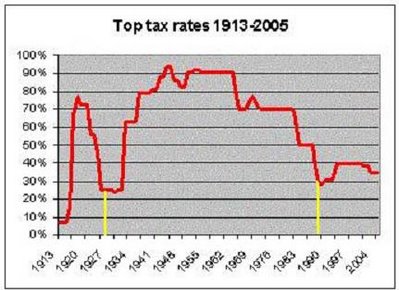

According to the US Treasury, "the entry of the United States into World War I greatly increased the need for revenue and Congress responded by passing the 1916 Revenue Act. The 1916 Act raised the lowest tax rate from 1 percent to 2 percent and raised the top rate to 15 percent. Another revenue act was passed in 1918, which hiked tax rates once again, this time raising the bottom rate to 6 percent and the top rate to 77 percent."

Graphic from msn.com

After WW1 tax rates dropped during the "Roaring Twenties" as income disparity increased until the Stock Market crash of 1929, the start of the Depression. Under the guidance of Franklin D. Roosevelt, tax progressivity returned, and the top tax rates went up, programs like Social Security and Unemployment relief got started, the CCC & the WPA put people back to work creating infrastructure thats still in use to this day.

My Parents got thru the Depression with a progressive income tax, we won WW2 with a progressive income tax. The 12 million men & woman that served in the military in WW2 came home, the GI Bill sent vets to college, and they started families. This created the largest, most vigorous and the best educated middle class, in the history of the planet. Labor unions were at the zenith of their power, our educational institutions were the envy of the world, corporations made money, the wealthiest made money. The American Dream was born.

Thom Hartman wrote , " but the real events of the 1930s and 1940s that set the stage for a second American Middle Class were primarily the Wagner Act, the G.I. Bill, and tax changes ranging from raising the top rate on the most rich to 90 percent to offering an emerging middle class home interest tax deductions."

Hartman known for, among other things, quoting Jefferson, continues, "Progressive taxation has a long history: As Jefferson said in a 1785 letter to James Madison, "Another means of silently lessening the inequality of property is to exempt all from taxation below a certain point, and to tax the higher portions of property in geometrical progression as they rise." Hartman concludes, "Progressive taxation has helped create every middle class in the First World, and without it the middle class will vanish."

Enter Ronald Reagan and the start of full spectrum warfare on the middle class. The opening salvo, the PATCO strike. Busting the Air Traffic Controllers union was the start of a multi front military style operation to drive wages down for all Americans. Then we were told that Social Security was going broke, this represents the opening of a second front of the War on the Middle Class that resulted in the doubling of payroll taxes.

The blue line on the bottom shows payroll taxes increasing two fold, while taxes for corporations have been cut by a third (green) and taxes for the wealthiest Americans have been cut by two thirds (purple).

Thom Hartman on Ronald Regan, "But as president, Reagan cut the top tax rate for billionaires from 70 percent to 28 percent, while effectively raising taxes on working people via the payroll tax and using inflation against a non-indexed tax system. It was another hit to the already-beginning-to-shrink middle class, to be followed by more "tax cut" bludgeons during the first three years of the W. Bush administration."

Thom Hartman on Ronald Regan, "But as president, Reagan cut the top tax rate for billionaires from 70 percent to 28 percent, while effectively raising taxes on working people via the payroll tax and using inflation against a non-indexed tax system. It was another hit to the already-beginning-to-shrink middle class, to be followed by more "tax cut" bludgeons during the first three years of the W. Bush administration."

Acting as the propaganda mill of the Aristocracy, groups like the Heritage Foundation have been telling us there is nothing to see, move along. In this example, the chart tells us that high tax rates don't raise more revenue. If this was true why would the Government raise taxes in wartime? In fact the US Treasury states that the result of these taxe rate increases, in both World Wars, did result in increased revenue. Whats more telling is the fine print on this chart, the 2 bottom lines are labeled "federal taxes as a % of GDP" & "Income taxes as a % of GDP."

Well I would offer to the Heritage Foundation that since 1940 GDP per capita has increased 80 fold, it might be fair to assume that as a % of GDP, so have tax revenues. The real point is not producing more tax revenues, the point is having a large and vigorous middle class that can participate as a citizen legislators, send its kids to college, so those kids can invent lots of cool stuff for the corporations to make money off of. Consider kids as assets. How do you make best use of those assets? Educate those assets of course.

I thought it mildly interesting that the Great Republican Depression starting with the Crash of '29, and the 2 year recession in '89 to '90, were periods of low tax rates on the wealthy, and occurred durig Republican Administrations.

A War on the Middle Class generally attacks the 3 pillars holding up the middle class. Progressive taxes, labor & education. Again I look to Thom Hartman: Jefferson said, in an 1824 letter: "This degree of [free] education would ... give us a body of yeomanry, too, of substantial information, well prepared to become a firm and steady support to the government." Jefferson started the University of Virginia with the intent to provide the yeomanry with a free education so as to be prepared to take part in the Government, the citizen legislators if you will.

The current war on the middle class started with less progressivity in tax rates, then union busting. More recently, tax breaks for corporations to move our jobs overseas, increasing illegal immigration to enlarge the labor pool, which drives wages down. The Bush Jr. tax policy is regressive while Bill Clinton's tax policy was much less regressive and was moving to true progressivity. Additionally we've seen 20 billion in cuts from student aid during the last 2 years. This is warfare my friends, the Aristocracy has attacked us, and we must defend ourselves.

6 comments:

This is an excellent post, quite informative.

I remember in William Hoffman's biography of the Rockafeller family (David), he wrote about a number of different ways that the extremely wealthy got out of paying income tax altogether--through tax shelters and creativitiy--and boasted about it.

Increased revenue is also the result of increasing population that translates into a larger work force. Republican policy has been and always will be to provide for the wealthy at the expense of everyone else.

The Republicans, with the aid of the corporate media, have successfully convinced a large part of the population that they are among the wealthy when in fact they are not. And thus they vote against their own best interests. One of their methods is veiled bigotry wherein they divide the working class by subtly implying that people with darker skin are a drain on the treasury because of social programs designed to raise living standards for the least among us. Compared with runaway defense spending, social programs are a mere pittance. Of course what is never discussed is that the largest portion of these social programs are funneling money to rural white people in the South, the last bastion of slavery in America.

Nixon's law and order theme was code for "we'll keep the minorities in their palce." Reagan and Bush effectively used the traditional values theme which really meant slavery and its bastard offsprings, segregation and Jim Crow laws.

In essence Republican dogma nurtures people's worst fears and lowest instincts, and ther great dumbing down fostered by those very same Republicans has caused the citizenry to drop critical thinking from its educational process, hence defunding education works for the Republican elites.

Trickle down economics is a failed theory propounded by the wealthy that says the wealthy know how to handle money better than everyone else, thus ensuring their continued wealth, deserved or not. If anyone can explain why Paris Hilton deserves a tax cut on the backs of disabled veterans please step forward.

The extra cash realized by the wealthy under the Bush junta and Republican jihad will end up in off-shore tax havens and never circulate into the economy, therefore lowering living standards for the vast majority of Americans.

Huey Long, "The Kingfish," summed it up best when he said money was like manure. If you spread it around it makes things grow, but when it piles up in one place it starts to stink.

It was the populist Long who forced FDR to adopt the New Deal by threatening to run against Roosevelt in a primary, thereby posing a popular alternative to Roosevelt's re-election. FDR gave us the New Deal and the greatest middle-class expansion in history resulted in higher living standards for all.

It is incumbent on working people across America to reject the politics of fear and loathing and return the national treasure to those who make their money the old fashioned way, earning it.

Wiz, you put it well.

You left out an important piece of tax history in the fifties and sixties there was an ongoing argument about high rates which were not the effective rate actually paid. The argument was that our system worked based on the honesty and willingness to pay taxes perceived as fair and equitable. The tax cuts passed in Kennedys' administration were based somewhat on the beleif that if the rates were considered fairer there would be less cheating and avoidance and the actual taxes collected would rise. This did happen. Reagan and the republicans have regularly abused and distorted this to eliminate corporate income taxes and taxes on the wealthy.

Dan,

Right, that was when the top rate was dropped from 92% to 86%.

The Goal of the my post was to cover the basics, A Jeffersonian democracy needs a middle class, and the middle class relies on 3 things, Labor rights, Progressive taxes & Education.

Post a Comment