At a recent meeting of progressives in NJ, a fellow progressive professed astonishment when I told him the top tax rate used to be 92%, in fact he did not believe me. This incident motivated me to get my ducks in a row and the result is what you see below.

A Middle class is a rare thing, occurring only 3 times thru-out history. The first rising of a middle class occurred as a result of the Black Plague. The Black Plague killed about 30% of the worlds population, creating a labor shortage. This allowed that Trades & Craftsman to command a higher wage, which trickled down to the common yeoman, much as the unionization of US labor in the middle 1900's allowed non union labor to command wages akin to union labor. Some have written that the renaissance, without a middle class that had the leisure time to even consider art & music, let alone the time to paint, sculpt, write & perform music, would have never occurred.

The second rising of a middle class occurred in the US colonies in the middle 1700's. Once a few Indians were driven away from an area, there was free land available for farming. In an agrarian society this was a big deal in that you could own your own land, grow & sell your own crops & keep the profits, much as a family owned business does today.

The third rising of a middle class occurred during the Great Republican Depression of the early 1930's. FDR's New Deal brought forward tax progressivity, as well as labor rights earned thru the union movement, such as the Child Labor laws passed in 1937 & 1938, (Kids do belong in school after all). But I've gotten ahead of myself, let me backtrack a bit.

According to the

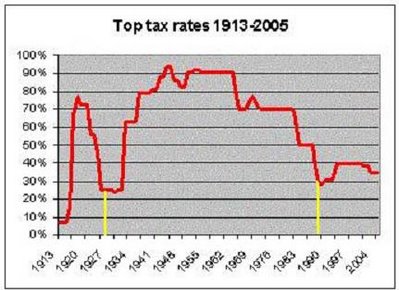

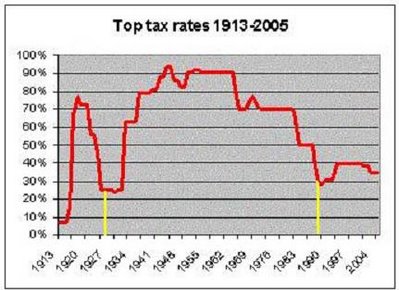

US Treasury, "the entry of the United States into World War I greatly increased the need for revenue and Congress responded by passing the 1916 Revenue Act. The 1916 Act raised the lowest tax rate from 1 percent to 2 percent and raised the top rate to 15 percent. Another revenue act was passed in 1918, which hiked tax rates once again, this time raising the bottom rate to 6 percent and the top rate to 77 percent."

Graphic from msn.com

After WW1 tax rates dropped during the "Roaring Twenties" as income disparity increased until the Stock Market crash of 1929, the start of the Depression. Under the guidance of Franklin D. Roosevelt, tax progressivity returned, and the top tax rates went up, programs like Social Security and Unemployment relief got started, the CCC & the WPA put people back to work creating infrastructure thats still in use to this day.

My Parents got thru the Depression with a progressive income tax, we won WW2 with a progressive income tax. The 12 million men & woman that served in the military in WW2 came home, the GI Bill sent vets to college, and they started families. This created the largest, most vigorous and the best educated middle class, in the history of the planet. Labor unions were at the zenith of their power, our educational institutions were the envy of the world, corporations made money, the wealthiest made money. The American Dream was born.

Thom Hartman

wrote , " but the real events of the 1930s and 1940s that set the stage for a second American Middle Class were primarily the Wagner Act, the G.I. Bill, and tax changes ranging from raising the top rate on the most rich to 90 percent to offering an emerging middle class home interest tax deductions."

Hartman known for, among other things, quoting Jefferson, continues, "Progressive taxation has a long history: As Jefferson said in a 1785 letter to James Madison, "Another means of silently lessening the inequality of property is to exempt all from taxation below a certain point, and to tax the higher portions of property in geometrical progression as they rise." Hartman concludes, "Progressive taxation has helped create every middle class in the First World, and without it the middle class will vanish."

Enter Ronald Reagan and the start of full spectrum warfare on the middle class. The opening salvo, the PATCO strike. Busting the Air Traffic Controllers union was the start of a multi front military style operation to drive wages down for all Americans. Then we were told that Social Security was going broke, this represents the opening of a second front of the War on the Middle Class that resulted in the doubling of payroll taxes.

The blue line on the bottom shows payroll taxes increasing two fold, while taxes for corporations have been cut by a third (green) and taxes for the wealthiest Americans have been cut by two thirds (purple).

Thom Hartman on Ronald Regan, "But as president, Reagan cut the top tax rate for billionaires from 70 percent to 28 percent, while effectively raising taxes on working people via the payroll tax and using inflation against a non-indexed tax system. It was another hit to the already-beginning-to-shrink middle class, to be followed by more "tax cut" bludgeons during the first three years of the W. Bush administration."

Acting as the propaganda mill of the Aristocracy, groups like the Heritage Foundation have been telling us there is nothing to see, move along. In this example, the chart tells us that high tax rates don't raise more revenue. If this was true why would the Government raise taxes in wartime? In fact the US Treasury states that the result of these taxe rate increases, in both World Wars, did result in increased revenue. Whats more telling is the fine print on this chart, the 2 bottom lines are labeled "federal taxes as a % of GDP" & "Income taxes as a % of GDP."

Well I would offer to the Heritage Foundation that since 1940 GDP per capita has increased 80 fold, it might be fair to assume that as a % of GDP, so have tax revenues. The real point is not producing more tax revenues, the point is having a large and vigorous middle class that can participate as a citizen legislators, send its kids to college, so those kids can invent lots of cool stuff for the corporations to make money off of. Consider kids as assets. How do you make best use of those assets? Educate those assets of course.

I thought it mildly interesting that the Great Republican Depression starting with the Crash of '29, and the 2 year recession in '89 to '90, were periods of low tax rates on the wealthy, and occurred durig Republican Administrations.

A War on the Middle Class generally attacks the 3 pillars holding up the middle class. Progressive taxes, labor & education. Again I look to Thom Hartman: Jefferson said, in an 1824 letter: "This degree of [free] education would ... give us a body of yeomanry, too, of substantial information, well prepared to become a firm and steady support to the government." Jefferson started the University of Virginia with the intent to provide the yeomanry with a free education so as to be prepared to take part in the Government, the citizen legislators if you will.

The current war on the middle class started with less progressivity in tax rates, then union busting. More recently, tax breaks for corporations to move our jobs overseas, increasing illegal immigration to enlarge the labor pool, which drives wages down. The Bush Jr. tax policy is regressive while Bill Clinton's tax policy was much less regressive and was moving to true progressivity. Additionally we've seen 20 billion in cuts from student aid during the last 2 years. This is warfare my friends, the Aristocracy has attacked us, and we must defend ourselves.