The question I ask tonite is what sort of society do we want?

Do we allow the wealthy to oppress the rest of us? Do we call for a more Egalitarian society? (Less economic oppression) Low tax rates like we've had since Reagan are considered progressive, but they have a regressive effect, taxing the working poor and middle classes out of the economy, as a result families are less capable of taking care of their own, and more often than not rely on government hand outs.

When tax rates are high enough, the working poor and middle classes are engaged in the economy. The point is having a large and vigorous middle class that can participate as citizen legislators, send its kids to college, so those kids can invent lots of cool stuff for the corporations to make money off of. Consider kids as assets. How do you make best use of those assets? Educate those assets of course.

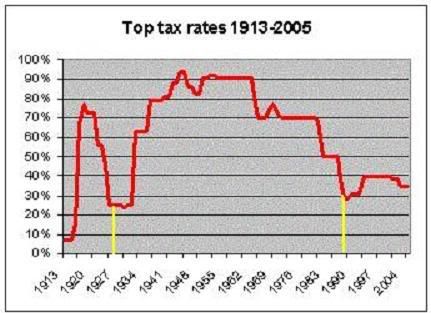

The above chart is from the Heritage Foundation, the infamous conservative think tank, where much of the Kool Aid is actually manufactured. The really funny thing is, when reading the title, the opposite is also true, lower tax rates don't raise more revenue.

The Progressive Policy Institute says basically the same thing, comparing real low tax rates to real high tax rates.By itself, economic theory cannot choose between the two cases, and hard economic evidence does not fully support either side.

If low rates or high rates raised more revenue there would a correlation between the next 2 charts:

As you can see, Reagans 28% raised no more revenue as a percent of GDP, than when Ike jacked up the top rate to 94%. (IIRC there was a recession caused when Ike went too high) I fail to see any real relation to tax rates and revenue, but I do see a relation to low tax rates and economic oppression (Do you see those 2 yellow lines?).

Not too long ago Thom Hartmann wrote:

"Progressive taxation has a long history: As Jefferson said in a 1785 letter to James Madison, "Another means of silently lessening the inequality of property is to exempt all from taxation below a certain point, and to tax the higher portions of property in geometrical progression as they rise." Hartman concludes, "Progressive taxation has helped create every middle class in the First World, and without it the middle class will vanish."

As a percent of GDP, revenues are incredibly consistent, Something I think Bill Clinton clearly understood when he raised the top rate a little and concentrated on getting the economy really ramped up, as GDP increased so did revenue, and over time Clinton was able to balance the budget. And do note that the economic stimulus happens first, and balancing the budget occurs later. FDR wanted to balance the budget in 1937, after all GDP in 1936 was a touch higher than inn 1929, 1936 was a good year, nearly 14% GDP growth, hours worked were down, wages were up But FDR made the mistake of cutting back the WPA and the rest of the stim programs in 1937, causing a recession. FDR learned his lesson and brought back the stim packages he had cut, plus he added a 200 ship navy building program.

If all you want to do is balance the budget, then just get the economy cranked up. If you want the idea called democracy to work, where folks get involved in participatory government, then you must stop economic oppression in the form of a tax system that taxes the majority of us out of the economy, and leaves running for office an entitlement for inherited money.

So at this point I am renewing my call for an increase of the Individual top tax rate to at least 60%, and using a minimum of 10 tax brackets to get the proper progressivity amongst the top quintile of income earners. In simple terms if you have individual income, not family income, of 90k, you'll see a tax break. I'm not just talking about letting the Bush tax cuts sunset, I'm talking about sunsetting Reagans 60% tax cut for the richest amongst us.

And don't even get me started on the 12 millin jobs we need and the stimulus to craete them, Arrggg.....